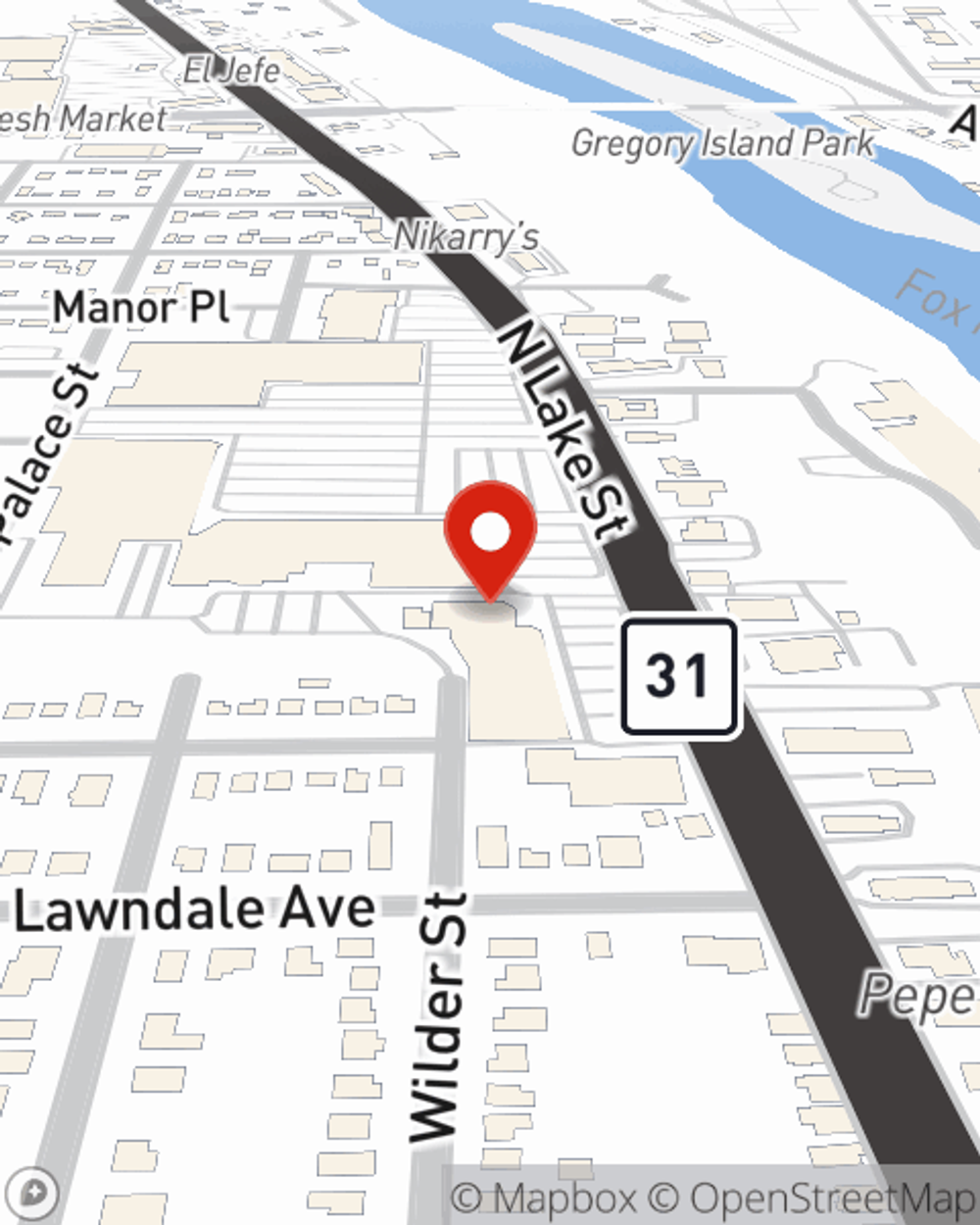

Condo Insurance in and around Aurora

Looking for outstanding condo unitowners insurance in Aurora?

State Farm can help you with condo insurance

- Aurora

- Oswego

- North Aurora

- Montgomery

- Naperville

- Batavia

- Geneva

- Yorkville

- Sugar Grove

- St Charles

- Plainfield

- Warrenville

- West Chicago

- Carol Stream

- Bartlett

- Schaumburg

- Elgin

- South Elgin

- Bloomingdale

- Chicago

Welcome Home, Condo Owners

Looking for a policy that can help insure both your condominium and the sound equipment, souvenirs, cookware? State Farm offers impressive coverage options you don't want to miss.

Looking for outstanding condo unitowners insurance in Aurora?

State Farm can help you with condo insurance

Condo Coverage Options To Fit Your Needs

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condominium from fire, an ice storm or water damage.

There is no better time than the present to visit agent Nick Cortino and ask any questions you may have about your condo unitowners insurance options. Nick Cortino would love to help you find the most appropriate coverage for you.

Have More Questions About Condo Unitowners Insurance?

Call Nick at (630) 896-7606 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Nick Cortino

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.